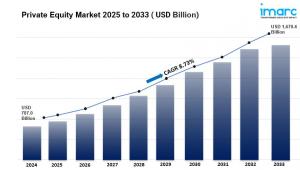

Private Equity Market is Expected to Reach USD 1,670.43 Billion by 2033 | At CAGR 8.73%

The global private equity market size to reach USD 1,670.43 Billion by 2033, exhibiting a CAGR of 8.73% from 2025-2033.

NEW YORK, NY, UNITED STATES, December 8, 2025 /EINPresswire.com/ -- 𝗣𝗿𝗶𝘃𝗮𝘁𝗲 𝗘𝗾𝘂𝗶𝘁𝘆 𝗠𝗮𝗿𝗸𝗲𝘁 𝗢𝘃𝗲𝗿𝘃𝗶𝗲𝘄:The global private equity market was valued at USD 787 Billion in 2024 and is projected to reach USD 1,670.43 Billion by 2033, exhibiting a CAGR of 8.73% during the 2025-2033 forecast period. Increasing demand for alternative investments, strong corporate growth opportunities, and rising capital inflows from institutional investors are driving this growth. The private equity market size is expanding rapidly due to the rising demand for alternative investments offering higher returns compared to traditional asset classes. Private equity refers to the investment of capital in privately held companies or the acquisition of publicly traded companies to transition them into private ownership. It is typically made by private equity firms, venture capitalists, or institutional investors seeking higher returns over a medium to long-term period. Institutional investors, such as pension funds and sovereign wealth funds, are allocating notable capital to private equity due to its potential for long-term gains. Technological advancements, including artificial intelligence (AI) and data analytics, are enhancing decision-making and operational efficiencies, making the market more appealing.

Additionally, the focus on high-growth sectors, such as technology, healthcare, and renewable energy, is attracting considerable private equity investments. Furthermore, the implementation of favorable regulatory frameworks and tax incentives in key regions is fostering a conducive environment for private equity activity.

𝙎𝙩𝙪𝙙𝙮 𝘼𝙨𝙨𝙪𝙢𝙥𝙩𝙞𝙤𝙣 𝙔𝙚𝙖𝙧𝙨

• Base Year: 2024

• Historical Year/Period: 2019-2024

• Forecast Year/Period: 2025-2033

𝗣𝗿𝗶𝘃𝗮𝘁𝗲 𝗘𝗾𝘂𝗶𝘁𝘆 𝗠𝗮𝗿𝗸𝗲𝘁 𝗞𝗲𝘆 𝗧𝗮𝗸𝗲𝗮𝘄𝗮𝘆𝘀

• Current Market Size: USD 787 Billion (2024)

• CAGR: 8.73% (2025-2033)

• Forecast Period: 2025-2033

• The market is estimated to reach USD 1,670.43 Billion by 2033.

• North America dominates as the largest market, holding over 33.8% market share, driven by robust financial infrastructure and significant investor activity.

• Buyout is the leading fund type segment, driven by its focus on acquiring controlling stakes in established companies.

• The United States holds 88.0% of the North American market share.

• Market growth is supported by enhanced returns compared to traditional asset classes, technological innovation, and favorable regulatory frameworks.

𝗥𝗲𝗾𝘂𝗲𝘀𝘁 𝗬𝗼𝘂𝗿 𝗙𝗿𝗲𝗲 “𝗣𝗿𝗶𝘃𝗮𝘁𝗲 𝗘𝗾𝘂𝗶𝘁𝘆 𝗠𝗮𝗿𝗸𝗲𝘁” 𝗜𝗻𝘀𝗶𝗴𝗵𝘁𝘀 𝗦𝗮𝗺𝗽𝗹𝗲 𝗣𝗗𝗙: https://www.imarcgroup.com/private-equity-market/requestsample

𝗠𝗮𝗿𝗸𝗲𝘁 𝗚𝗿𝗼𝘄𝘁𝗵 𝗙𝗮𝗰𝘁𝗼𝗿𝘀

The private equity market is being propelled by increased investor appetite for alternative investments, pursuit of higher returns amidst market volatility, and favorable regulatory environments. The increasing shift in investor preference for alternative investments is one of the primary market trends. Growing interest in traditional investment options like stocks and bonds on account of their volatility and lower returns due to factors such as geopolitical uncertainties, fluctuating interest rates, and market saturation is contributing to market growth. As a result, institutional investors, pension funds, endowments, and high-net-worth individuals are allocating capital to alternative assets, seeking diversification and higher yields to meet their investment objectives. US private equity deals were valued at USD 611 billion as of September 30, 2023. Various key companies are offering their equity to private players and high-net-worth individuals to raise investments and reduce burnout. For instance, Toshiba Corp.'s board accepted a buyout offer from a group led by private equity firm Japan Industrial Partners, valuing the company at 2 trillion yen (USD 15.2 billion).

The unpredictable economic conditions and ongoing market volatility are driving investors to seek alternative avenues for generating superior risk-adjusted returns. Investors are focusing on long-term value creation, streamlining operations, and active management, which can be achieved through investments in private equity since they are more reliable and offer higher yields and capital appreciation. The US Private Equity Index provided by Cambridge Associates shows that private equity produced average annual returns of 10.48% over the 20-year period ending on June 30, 2020. During that same timeframe, the Russell 2000 Index averaged 6.69% per year, while the S&P 500 returned 5.91%. The illiquid nature of private equity investments allows fund managers to pursue contrarian investment opportunities and capitalize on market inefficiencies, mitigating short-term market volatility and aligning investor interests with long-term value creation.

Regulatory reforms and evolving market dynamics are contributing to a favorable environment for private equity investments across the globe. Regulatory changes, such as the relaxation of restrictions on fundraising, the easing of investment barriers, and favorable tax policies, are facilitating the growth of the private equity industry and expanding investment opportunities across geographies and sectors. For instance, Composition Capital, led by Nishita Cummings and Leon Chen, launched as an independent private equity firm providing growth capital to technology companies. The duo previously managed USD 1.3 billion across 6 funds at Kayne Partners. In August 2023, the U.S. Securities and Exchange Commission (SEC) approved the introduction of the Private Fund Adviser Rules, requiring private equity firms and hedge funds to detail all fees and expenses on a quarterly basis, protecting investors from miscommunication and fraudulent activity.

Another contributor is the integration of technological advancements in private equity operations. Advancements in technology and communication have enabled private equity firms to access a broader pool of investment opportunities, conduct due diligence more efficiently, and monitor portfolio performance in real-time. Private equity firms are focusing on funding innovation in supply chains, providing capital and expertise to small businesses. In 2024, ASTRO America announced final federal approval for the Stifel North Atlantic AM-Forward Fund to boost additive manufacturing adoption in US supply chains, backed by Lockheed Martin and GE Aerospace. Additionally, the development of specialized private equity divisions by leading companies reflects a strategic effort to attract high-net-worth individuals and institutional investors. In September 2024, InvesTek introduced a Private Equity Business Unit to provide strategic investment opportunities in late-stage and pre-IPO companies in emerging sectors.

𝗠𝗮𝗿𝗸𝗲𝘁 𝗦𝗲𝗴𝗺𝗲𝗻𝘁𝗮𝘁𝗶𝗼𝗻

• 𝙁𝙪𝙣𝙙 𝙏𝙮𝙥𝙚:

o Buyout: Dominates the market due to its focus on acquiring controlling stakes in established companies to drive operational and financial improvements; caters to investors seeking substantial returns through strategic transformations and long-term value creation.

o Venture Capital (VCs): Provides funding to early-stage and high-growth potential startups, particularly in technology and innovation sectors.

o Real Estate: Focuses on property investments, development projects, and real estate portfolios for capital appreciation and rental income.

o Infrastructure: Invests in essential facilities and systems, including transportation, utilities, and communication networks for stable long-term returns.

o Others: Includes specialized funds targeting niche sectors such as distressed assets, mezzanine financing, and fund-of-funds strategies.

𝗥𝗲𝗴𝗶𝗼𝗻𝗮𝗹 𝗜𝗻𝘀𝗶𝗴𝗵𝘁𝘀

North America currently dominates the market with over 33.8% share in 2024, driven by its well-established financial infrastructure and notable investor activity. The United States holds 88.0% of the North American market share, driven by favorable economic conditions, technological innovation, and evolving investor preferences. According to PwC, passive funds are expected to increase from 44% to 58% of total US mutual fund and ETF assets by 2030, reflecting a shift towards lower-cost investment options. The robust startup ecosystem, particularly in emerging hubs beyond Silicon Valley, provides ample opportunities in venture capital-backed companies. The availability of liquidity, low interest rates, and an active secondary market further bolster fundraising and exit strategies. As sustainability becomes a key concern, private equity firms are integrating ESG (Environmental, Social, and Governance) frameworks to attract institutional investors. In June 2024, Niobrara Capital Partners was established as a private equity firm focused on the middle market in North America and Europe.

Europe's private equity sector thrives due to a developed financial ecosystem, varied industries, and government-supported innovation efforts. Eurostat reports that on January 1, 2023, the estimated population of the EU was 448.8 million, with more than 21% (roughly 95 million) being 65 years or older. This demographic shift leads to considerable demand for healthcare, life sciences, and retirement services, generating appealing investment prospects. The technology industry continues to be a primary area of interest, highlighting fintech, cleantech, and artificial intelligence. The European Green Deal and targets for decarbonization boost investments in sustainable energy and infrastructure initiatives. Mid-market buyouts and bolt-on acquisitions remain key strategies for private equity firms aiming for value enhancement.

The Asia-Pacific region is driven by swift economic growth, technological advancements, and increasing urbanization. UNICEF reports that almost 55% of Asia's large population is projected to reside in urban regions by 2030, increasing the need for infrastructure, real estate, and digital services. Key markets such as China and India lead the way, featuring growing startup ecosystems and governmental efforts backing industries like fintech, healthcare, and e-commerce. The increasing middle class and higher disposable incomes generate appealing investment opportunities. Furthermore, the growing emphasis on sustainability and digital transformation is influencing investment approaches, as private equity companies aim for tech-oriented solutions and ESG-compliant projects.

Latin America's private equity market is supported by the swift expansion of digital industries, notably e-commerce, which experienced a 39% increase in 2022. This upward trend is anticipated to persist, with e-commerce expected to grow by more than 20% each year. The area enjoys a youthful, technologically adept populace, rising mobile adoption, and growing fintech prospects. Governments are advancing infrastructure and energy reforms, drawing in long-term private equity investments.

The Middle East and Africa (MEA) market is driven by economic diversification, increasing technology investments, and infrastructure growth. In the Middle East, state efforts like Vision 2030 are transforming economies by decreasing reliance on oil and promoting innovation. In Africa, the swift increase in mobile internet users, surpassing 380 million by late 2021 (60% of the population), is fostering expansion in areas such as fintech and digital payments. These trends, coupled with investments in renewable energy and infrastructure, draw private equity funding. Sovereign wealth funds and development finance institutions are playing a key role in funding impactful projects.

𝐑𝐞𝐜𝐞𝐧𝐭 𝐃𝐞𝐯𝐞𝐥𝐨𝐩𝐦𝐞𝐧𝐭𝐬 & 𝐍𝐞𝐰𝐬

• September 2024: InvesTek introduced a Private Equity Business Unit to provide high-net-worth individuals and institutional investors with strategic investment opportunities, focusing on late-stage and pre-IPO companies in emerging sectors.

• June 2024: Niobrara Capital Partners was established as a private equity firm focused on the middle market, aiming for strategic investments in technology and tech-enabled services in North America and Europe.

• 2024: ASTRO America announced final federal approval for the Stifel North Atlantic AM-Forward Fund to boost additive manufacturing adoption in US supply chains, backed by Lockheed Martin and GE Aerospace.

• August 2023: The U.S. Securities and Exchange Commission (SEC) approved the introduction of the Private Fund Adviser Rules, requiring private equity firms and hedge funds to detail all fees and expenses on a quarterly basis.

𝗞𝗲𝘆 𝗣𝗹𝗮𝘆𝗲𝗿𝘀

• AHAM Asset Management Berhad

• Allens

• Apollo Global Management, Inc.

• Bain and Co. Inc.

• Bank of America Corp.

• BDO Australia

• Blackstone Inc.

• CVC Capital Partners

• Ernst and Young Global Ltd.

• HSBC Holdings Plc

• Morgan Stanley

• The Carlyle Group

• Warburg Pincus LLC

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

𝗔𝘀𝗸 𝗔𝗻 𝗔𝗻𝗮𝗹𝘆𝘀𝘁: https://www.imarcgroup.com/request?type=report&id=8078&flag=C

𝗔𝗯𝗼𝘂𝘁 𝗨𝘀

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Elena Anderson

IMARC Services Private Limited

+1 201-971-6302

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.