0755461 B.C. LTD. PROVIDES CORRECTIVE DISCLOSURE IN CONNECTION WITH SHAREHOLDERS AGSM AND APPOINTS ROBERT LONGO AS COO

TORONTO, ONTARIO, CANADA, June 23, 2025 /EINPresswire.com/ -- 0755461 B.C. Ltd. (the “Company”) wishes to provide supplemental and corrective disclosure to its Management Information Circular dated May 29, 2025 (the “Circular”) in respect of the Company’s annual general and special meeting of shareholders to be held on June 30, 2025 (the “Meeting”).

Capitalized terms not otherwise defined below shall have the meanings ascribed to such terms in the Circular. The Company wishes to provide additional disclosure relating to the Related Party Material Share Issuance Resolution to supplement and correct the corresponding disclosure in the Circular. Shareholders are encouraged to read the Circular, which is available on the Company’s profile on SEDAR+ at www.sedarplus.ca.

Related Party Material Share Issuance Resolution

At the Meeting, pursuant to the Related Party Material Share Issuance Resolution, shareholders are being asked to consider, and if thought advisable pass, with or without variation, an ordinary resolution, authorizing and approving an issuance of up to 2,839,447 post-Consolidation Common Shares to certain Related Parties. As disclosed on page 28 of the Circular, pursuant to the Transaction, SubCo and another wholly-owned subsidiary of the Company will amalgamate pursuant to a three-cornered amalgamation and the holders of common shares in the capital of SubCo (“SubCo Common Shares”) will exchange their SubCo Common Shares for post-Consolidation Common Shares on a one-for-one basis.

As disclosed on page 30 of the Circular, the Company proposes to issue 2,809,447 SubCo Common Shares to Canadian Shield Holdings & Consulting Inc. (“Canadian Shield”), a 10% securityholder and insider of the Company. The disclosure provides that Canadian Shield shall receive these SubCo Shares because it has a convertible debenture outstanding for an aggregate amount of $55,930, inclusive of interest (the “Canadian Shield Debenture”) and in lieu of cash payment, the Canadian Shield Debenture shall: (i) be assumed by SubCo; (ii) the conversion price of the Canadian Shield Debenture shall be amended; and (iii) and 2,809,447 SubCo Common Shares shall be issued in satisfaction of the Canadian Shield Debenture.

The Company clarifies that certain SubCo Common Shares are being issued to Canadian Shield for payment of outstanding finder’s fees owed to Canadian Shield (the “Finder’s Fees”) in connection with the Transaction. In connection with the Transaction: (i) the Canadian Shield Debenture will be assumed by SubCo; (ii) the conversion price of the Canadian Shield Debenture will be amended to reduce the original conversion price from $0.000668 to $0.00002001160253; and (iii) as a result, 2,809,447 SubCo Common Shares are being issued to Canadian Shield in full satisfaction of the Canadian Shield Debenture and Finder Fee’s. Of the 2,809,447 SubCo Common Shares issued, Canadian Shield is receiving 84,163 SubCo Common Shares as settlement for the Canadian Shield Debenture, and 2,725,284 SubCo Common Shares are being issued as a Finder’s Fee.

The Company’s decision to issue the SubCo Common Shares as settlement of the Canadian Shield Debenture and the Finder’s Fees was based on the following factors:

a. The Company agreed to pay Canadian Shield a finder’s fee in connection with the Transaction. As a result of the amendment to the conversion price of the Canadian Shield Debenture, the SubCo Common Shares issuable to Canadian Shield as the Finder’s Fee represent approximately 3.20% of the Transaction value.

b. The Company also considered that the issuance of the SubCo Common Shares in settlement of the Canadian Shield Debenture was reasonable in the circumstances since: (i) the Canadian Shield Debenture has matured and the Company had no ability to repay it, either through cash on hand or from proceeds of a financing; (ii) the issuance of the SubCo Common Shares to Canadian Shield was approved by the board of directors of the Company, which are independent of Canadian Shield; (iii) the issuance of the SubCo Common Shares to Canadian Shield is subject to the prior approval of the disinterested shareholders of the Company; (iii) the Company is in severe financial hardship, and had assets of $15,000 against liabilities of $399,124 as reported in its interim financial statements for the period ended January 31, 2025; and (iv) Canadian Shield has also advanced an aggregate of $60,000 to the Company (exclusive of the Canadian Shield Debenture), and has, as a condition to receiving the SubCo Common Shares set forth above, agreed to release the Company from these liabilities.

Prior to the completion of the Transaction and after the Consolidation and Material Share Issuances, it is anticipated that Canadian Shield will own and control 72.12% of the Common Shares. The Related Party Material Share Issuances, including those to Canadian Shield, will only be completed upon satisfaction of all closing conditions of the Transaction, other than the completion of the Related Party Material Share Issuances themselves, which is a condition to closing.

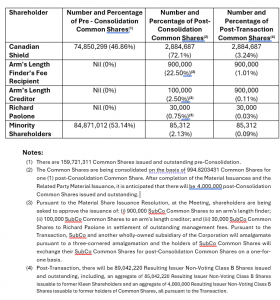

For clarity of the shareholdings pre- and post-Consolidation and pre- and post-Transaction, please see the chart set out below [Please refer to image #1]

New Chief Operating Officer Mr. Longo, the controlling shareholder of Canadian Shield, will act as Chief Operating Officer of the Company, effective today.

On behalf of the Company

Robert Longo

Chief Operating Officer

T: 416-880-5081

E: dreamscometrue@sympatico.ca

FORWARD-LOOKING INFORMATION

This news release contains forward-looking statements and forward-looking information within the meaning of applicable securities laws. The use of any of the words “expect”, “anticipate”, “continue”, “estimate”, “objective”, “ongoing”, “may”, “will”, “project”, “should”, “believe”, “plans”, “intends” and similar expressions are intended to identify forward- looking information or statements. The forward-looking statements and information contained in this press release include but are not limited to statements relating to the Transaction, the Meeting, Robert Longo’s role as Chief Operating Officer, the Related Party Material Share Issuances, and expectations about the future of the Company. The forward-looking statements made are based on certain key expectations and assumptions made by the Company including receipt of all regulatory approvals for the Transaction, receipt of Shareholder approval for all resolutions at the Meeting, and expectations that the Transaction will be beneficial for the Company.

Although the Company believes that the expectations and assumptions on which such forward-looking statements and information are based are reasonable, undue reliance should not be placed on the forward-looking statements and information because the Company can give no assurance that they will prove to be correct. Since forward-looking statements and information address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks. Among the key factors that could cause actual results to differ materially from those projected in the forward-looking information are the following: the ability to consummate the Transaction; the ability to obtain requisite regulatory and other approvals and the satisfaction of other conditions to the consummation of the Transaction on the proposed terms and schedule; the potential impact of the announcement or consummation of the Transaction on relationships, including with regulatory bodies, employees, suppliers, customers and competitors; changes in general economic, business and political conditions, including changes in the financial markets; changes in applicable laws; compliance with extensive government regulation; and the diversion of management time on the Transaction. This forward-looking information may be affected by risks and uncertainties in the business of Kleen and market conditions. Further Factors which could materially affect such forward-looking information are described in the risk factors in the Company’s most recent annual management’s discussion and analysis that is available on the Company’s profile on SEDAR+ at www.sedarplus.ca. Readers are cautioned that the foregoing list of factors is not exhaustive. The forward- looking statements included in this news release are expressly qualified by this cautionary statement. The forward-looking statements and information contained in this news release are made as of the date hereof and the Company undertakes no obligation to update publicly or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise, unless so required by applicable securities laws.

Capitalized terms not otherwise defined below shall have the meanings ascribed to such terms in the Circular. The Company wishes to provide additional disclosure relating to the Related Party Material Share Issuance Resolution to supplement and correct the corresponding disclosure in the Circular. Shareholders are encouraged to read the Circular, which is available on the Company’s profile on SEDAR+ at www.sedarplus.ca.

Related Party Material Share Issuance Resolution

At the Meeting, pursuant to the Related Party Material Share Issuance Resolution, shareholders are being asked to consider, and if thought advisable pass, with or without variation, an ordinary resolution, authorizing and approving an issuance of up to 2,839,447 post-Consolidation Common Shares to certain Related Parties. As disclosed on page 28 of the Circular, pursuant to the Transaction, SubCo and another wholly-owned subsidiary of the Company will amalgamate pursuant to a three-cornered amalgamation and the holders of common shares in the capital of SubCo (“SubCo Common Shares”) will exchange their SubCo Common Shares for post-Consolidation Common Shares on a one-for-one basis.

As disclosed on page 30 of the Circular, the Company proposes to issue 2,809,447 SubCo Common Shares to Canadian Shield Holdings & Consulting Inc. (“Canadian Shield”), a 10% securityholder and insider of the Company. The disclosure provides that Canadian Shield shall receive these SubCo Shares because it has a convertible debenture outstanding for an aggregate amount of $55,930, inclusive of interest (the “Canadian Shield Debenture”) and in lieu of cash payment, the Canadian Shield Debenture shall: (i) be assumed by SubCo; (ii) the conversion price of the Canadian Shield Debenture shall be amended; and (iii) and 2,809,447 SubCo Common Shares shall be issued in satisfaction of the Canadian Shield Debenture.

The Company clarifies that certain SubCo Common Shares are being issued to Canadian Shield for payment of outstanding finder’s fees owed to Canadian Shield (the “Finder’s Fees”) in connection with the Transaction. In connection with the Transaction: (i) the Canadian Shield Debenture will be assumed by SubCo; (ii) the conversion price of the Canadian Shield Debenture will be amended to reduce the original conversion price from $0.000668 to $0.00002001160253; and (iii) as a result, 2,809,447 SubCo Common Shares are being issued to Canadian Shield in full satisfaction of the Canadian Shield Debenture and Finder Fee’s. Of the 2,809,447 SubCo Common Shares issued, Canadian Shield is receiving 84,163 SubCo Common Shares as settlement for the Canadian Shield Debenture, and 2,725,284 SubCo Common Shares are being issued as a Finder’s Fee.

The Company’s decision to issue the SubCo Common Shares as settlement of the Canadian Shield Debenture and the Finder’s Fees was based on the following factors:

a. The Company agreed to pay Canadian Shield a finder’s fee in connection with the Transaction. As a result of the amendment to the conversion price of the Canadian Shield Debenture, the SubCo Common Shares issuable to Canadian Shield as the Finder’s Fee represent approximately 3.20% of the Transaction value.

b. The Company also considered that the issuance of the SubCo Common Shares in settlement of the Canadian Shield Debenture was reasonable in the circumstances since: (i) the Canadian Shield Debenture has matured and the Company had no ability to repay it, either through cash on hand or from proceeds of a financing; (ii) the issuance of the SubCo Common Shares to Canadian Shield was approved by the board of directors of the Company, which are independent of Canadian Shield; (iii) the issuance of the SubCo Common Shares to Canadian Shield is subject to the prior approval of the disinterested shareholders of the Company; (iii) the Company is in severe financial hardship, and had assets of $15,000 against liabilities of $399,124 as reported in its interim financial statements for the period ended January 31, 2025; and (iv) Canadian Shield has also advanced an aggregate of $60,000 to the Company (exclusive of the Canadian Shield Debenture), and has, as a condition to receiving the SubCo Common Shares set forth above, agreed to release the Company from these liabilities.

Prior to the completion of the Transaction and after the Consolidation and Material Share Issuances, it is anticipated that Canadian Shield will own and control 72.12% of the Common Shares. The Related Party Material Share Issuances, including those to Canadian Shield, will only be completed upon satisfaction of all closing conditions of the Transaction, other than the completion of the Related Party Material Share Issuances themselves, which is a condition to closing.

For clarity of the shareholdings pre- and post-Consolidation and pre- and post-Transaction, please see the chart set out below [Please refer to image #1]

New Chief Operating Officer Mr. Longo, the controlling shareholder of Canadian Shield, will act as Chief Operating Officer of the Company, effective today.

On behalf of the Company

Robert Longo

Chief Operating Officer

T: 416-880-5081

E: dreamscometrue@sympatico.ca

FORWARD-LOOKING INFORMATION

This news release contains forward-looking statements and forward-looking information within the meaning of applicable securities laws. The use of any of the words “expect”, “anticipate”, “continue”, “estimate”, “objective”, “ongoing”, “may”, “will”, “project”, “should”, “believe”, “plans”, “intends” and similar expressions are intended to identify forward- looking information or statements. The forward-looking statements and information contained in this press release include but are not limited to statements relating to the Transaction, the Meeting, Robert Longo’s role as Chief Operating Officer, the Related Party Material Share Issuances, and expectations about the future of the Company. The forward-looking statements made are based on certain key expectations and assumptions made by the Company including receipt of all regulatory approvals for the Transaction, receipt of Shareholder approval for all resolutions at the Meeting, and expectations that the Transaction will be beneficial for the Company.

Although the Company believes that the expectations and assumptions on which such forward-looking statements and information are based are reasonable, undue reliance should not be placed on the forward-looking statements and information because the Company can give no assurance that they will prove to be correct. Since forward-looking statements and information address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks. Among the key factors that could cause actual results to differ materially from those projected in the forward-looking information are the following: the ability to consummate the Transaction; the ability to obtain requisite regulatory and other approvals and the satisfaction of other conditions to the consummation of the Transaction on the proposed terms and schedule; the potential impact of the announcement or consummation of the Transaction on relationships, including with regulatory bodies, employees, suppliers, customers and competitors; changes in general economic, business and political conditions, including changes in the financial markets; changes in applicable laws; compliance with extensive government regulation; and the diversion of management time on the Transaction. This forward-looking information may be affected by risks and uncertainties in the business of Kleen and market conditions. Further Factors which could materially affect such forward-looking information are described in the risk factors in the Company’s most recent annual management’s discussion and analysis that is available on the Company’s profile on SEDAR+ at www.sedarplus.ca. Readers are cautioned that the foregoing list of factors is not exhaustive. The forward- looking statements included in this news release are expressly qualified by this cautionary statement. The forward-looking statements and information contained in this news release are made as of the date hereof and the Company undertakes no obligation to update publicly or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise, unless so required by applicable securities laws.

Robert Longo

0755461 B.C. Ltd.

dreamscometrue@sympatico.ca

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.